Table of Contents

- TSP Combat Zone Contributions

- How TSP Contributions Work in a Tax-Exempt Zone

- How to Use Combat Zone TSP Contributions to Maximum Advantage

- Why would anyone want to contribute $69,000/year to their TSP?!?

- Combat Zones

- What’s the Annual Addition Limit?

- How to reach the Annual Additions Limit

- The Roth TSP annual contribution limit is still $23,000

- If You’re In The BRS… then leave room in your Roth TSP for your monthly contributions

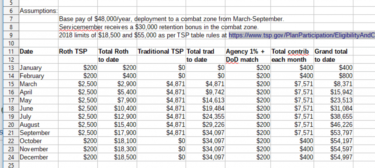

- Example: contributing $55,000 in 2018 to the TSP from a combat zone with the DoD BRS match

- What If You’re Still In The Legacy High Three Pension System?

- Note for “older” servicemembers

- A Friendly Little Note From The IRS

- Your Call To Action:

You can contribute up to $23,00 to your Thrift Savings Plan in 2024. These contributions can go into your Roth or Traditional TSP, or in any combination of the two, as long as they don’t exceed $23,000.

This $23,000 elective deferral limit only applies to your payroll contributions and does not include Department of Defense agency matching contributions from participating in the Blended Retirement System. If you contribute at least 5% of your base pay into your TSP every month of the year, then the DoD will match up to 5% of your base pay all year. These matching contributions count toward the Annual Addition Limit (see chart below).

Ready for some good news?

When you deploy, you can contribute far more than the $23,000 elective deferral limit. If you do it right, you can contribute up to the $69,000 Annual Addition Limit.

The following table shows current TSP contribution limits with more details. And if you stick around, we’ll show you how to maximize your TSP contributions in a combat zone:

| 2024 Thrift Savings Plan Limits | Maximum Contribution | Internal Revenue Code | Notes |

|---|---|---|---|

| Elective Deferral Limit | $23,000 | IRC §402(g) | Applies to the combined total of traditional and Roth contributions. For members of the uniformed services, this limit encompasses contributions from taxable basic pay, incentive pay, special pay and bonus pay. However, it does not apply to traditional contributions from tax-exempt income earned in a combat zone. |

| Maximum Annual Addition Limit | $69,000 | IRC §415(c) | Applies to the total amount of all contributions (per employer) made on behalf of an employee in a calendar year. This limit includes employee contributions (tax-deferred, after-tax and tax-exempt), agency/service automatic (1%) contributions and matching contributions. For 415(c) purposes, working for multiple federal agencies or services in the same year is considered having one employer. |

| Catch-Up Contribution Limit | $7,500 | IRC §414(v) | The maximum amount of annual catch-up contributions for participants age 50 and older. Catch-up contributions are separate from elective deferral and annual addition limits imposed on regular employee contributions. |

TSP Combat Zone Contributions

Because so many military families have learned the basics of contributing to the TSP, we’re getting a lot of questions about maximizing those contributions during deployments to combat zones.

Military pay in a combat zone is exempt from federal and state taxes, and servicemembers are also eligible for much higher contributions to the TSP. I’ll get into the gory details during this post, but for now, I’ll mention that the annual additions limit of the tax code is $69,000/year in 2024. That limit applies even when you’re not in the combat zone for the entire year! *

[* Note: That last sentence means your higher limits are still available if your deployment is less than the full calendar year. If you’re in the Blended Retirement System, you need to keep reading about leaving room in your Roth TSP for 12 months of contributions.]

How TSP Contributions Work in a Tax-Exempt Zone

Your pay and benefits are tax-exempt when in a combat zone. This gives you special tax treatment for TSP contributions.

- Roth TSP contributions before, during, and after your time in a tax-exempt zone count toward the elective deferral limit ($23,000).

- Traditional TSP contributions made before or after being in a tax-exempt zone count toward the elective deferral limit ($23,000).

- Traditional TSP contributions made while in a tax-exempt zone are listed as “Traditional tax-exempt contributions” and only count toward the annual addition limit ($69,000).

- DoD matching contributions count toward the annual addition limit ($69,000).

Note: The TSP will shut off all contributions once you reach the $23,000 elective deferral limit.

These contribution rules present unique opportunities that require planning before, during, and after your time in the combat zone. This is especially important for Blended Retirement System participants who receive matching contributions. We’ll run through some examples in this article to show you how to maximize your contributions through the end of the year.

Ensure you plan accordingly when making your TSP contribution elections in myPay (or Marine OnLine).

How to Use Combat Zone TSP Contributions to Maximum Advantage

IRS rules allow military members to contribute up to the annual addition limit of $69,000 when serving in a tax-exempt zone.

Later in this post, I’ll also answer the question that most of you are thinking about right now:

Hey Nords, I just checked my Leave and Earnings Statement, and, golly dude, I’m not getting paid $66K this *year*– let alone during this deployment. I have expenses, too. Where the heck are people getting the money for this?!?”

We’ll address that issue in excruciating detail (military families are extremely creative), but the basic response is, “Do the best you can with what you have.” You’ll be surprised at how much the DoD and the IRS will help you reach that goal, and this post includes the links to ensure it applies to you.

Let’s be clear: I would not volunteer to deploy to a combat zone just for the tax-free pay (and the special pay) and the higher contribution limits to retirement accounts. I would not even do it to pay off student loans or consumer debt. Yet that combat zone is why you joined the military, and as long as you’re there, you might as well make the most of your pay advantages.

But that leads to a good question.

Why would anyone want to contribute $69,000/year to their TSP?!?

Short answer: the TSP has some of the world’s largest passively managed index funds with some of the world’s lowest expense ratios. You can get tax-deferred compounding and tax-free withdrawals depending on how you contribute. You don’t even have to wait until age 59.5 to tap your TSP.

The TSP is one of several investing answers, but it should be a big part of every military family’s asset allocation plan. (Some might decide it’s the best part.) In the combat zone, you’re putting tax-free pay into the TSP. This offers a huge compounding advantage and means you have more money to contribute to your TSP account instead of “contributing” it to the U.S. Treasury’s income-tax fund via withholding and tax returns.

Finally (stay with me here), combat deployments are not exactly fun. (Not even submarine deployments.) We personal finance bloggers talk boldly about frugality versus deprivation and work-life balance, but let’s not kid ourselves: this deployment will be more work than life and a lot more deprivation. As long as you’re embracing the suck, you can still extract some value from the pain by investing as much as possible toward your financial independence life goal.

For a few of us, maximizing TSP contributions *during* a deployment is a great way to minimize lifestyle expansion *after * a deployment. Yeah, you worked hard, and you deserve a nice reward. Instead of a dollar-gobbling depreciating pile of a pickup truck, how about sleeping better at night knowing you’re on track for financial independence? Sure, give yourself a small victory lap party, but avoid the temptation of the hedonic treadmill by putting most of that money where it’s hard to frit away.

No worries, this post includes a detailed year-round example. I also have a spreadsheet for you to edit with your own numbers.

Next question: where are these combat zones?

Surprisingly, they don’t all involve actual combat. I hope.

Combat Zones

DoD and the Internal Revenue Service work with Congress to define combat zones. Here’s the text straight from the IRS press release:

The term ‘combat zone(s)’ is a general term used on IRS.gov and includes all of the following hostile areas where military may serve: actual combat areas, direct combat support areas, and contingency operations areas.”

(source)

I was surprised to learn that Djibouti, the Philippines, and even the Sinai Peninsula are eligible for combat zone benefits. The distinction is not whether you’re shooting but rather whether you could be shooting or whether you’re helping other people shoot. You’re also supposed to be getting imminent danger pay or hostile fire pay.

According to the IRS, there are three options:

- Service in an active combat area as designated by Executive Order, and receive special pay for duty subject to hostile fire or imminent danger as certified by DoD.

- Service in a support area as designated by DoD in direct sustainment of military operations in the combat zone, and receive special pay for duty subject to hostile fire or imminent danger as certified by DoD.

- Service in a contingency operation as designated by DoD, and receive special pay for duty subject to hostile fire or imminent danger as certified by DoD.

Read the fine print in the IRS notice, but if you’re getting that pay on deployment, then you’re probably eligible for the tax code’s annual additions limit to your TSP: $69,000/year in 2024.

What’s the Annual Addition Limit?

What does that limit look like? Review the chart at the top of the page again.

Here’s the important fine print from that chart:

This limit… includes employee contributions (tax-deferred, after-tax, and tax-exempt), Agency/Service Automatic (1%) Contributions, and Matching Contributions.”

In other words, that $69,000 limit now includes your DoD BRS agency/matching contributions. You’re not actually contributing all of that limit from your pay.

How to reach the Annual Additions Limit

- Because that limit includes the BRS agency/matching contributions, you must dial back your contributions to allow for DoD’s 5% match of your base pay. To make things even more complicated for the BRS, you’ll have to spread your 5% contributions across all 12 months of the calendar year, or you’ll miss some of the match.

- Here’s another good deal: by the definition of the combat zone, you’re getting more special pay (at least hostile fire or imminent danger pay). You lived without that money when you were in the U.S., and you can probably live without spending it in a combat zone. Since it’s tax-free, you can set your MyPay (or Marine OnLine) contribution percentage to 100% to contribute all of it to the TSP.

- Some of you have planned for the next good deal: bonus money. I am not a lawyer or a CPA or a CFP, and you’ll have to read your bonus contracts very carefully to make sure you’re eligible, but here’s the link: if you sign a bonus contract in a combat zone eligible for CZTE pay, then it’s not taxable.

Let’s be clear: I would not volunteer to re-enlist or sign a bonus contract in a combat zone just for the tax-free pay. (Yes, I get reader questions about how to volunteer for this.) I would not even do it to pay off student loans or consumer debt. Yet if you’re planning to obligate the service anyway, or if you’re eligible to sign up for the BRS Continuation Pay bonus between 8-12 years of service, then as long as you’re in the combat zone, you might as well make the most of your pay advantages.

Suddenly, that annual addition limit might be within your reach.

- Here’s another fine-print point that the BRS has highlighted: these annual addition limits are per calendar year, not just for the deployment. Let’s unpack that concept for several more paragraphs.

When you deploy to a combat zone (as defined above), you’re eligible for the annual additions limit for the rest of the calendar year. You’re contributing tax-free pay when you’re in the combat zone, yet you can continue to contribute taxable pay to the TSP after you leave the combat zone.

But there’s a catch, and after I published this post, it took me a couple more e-mails with the TSP to confirm it.

When you return home, any further contributions for the rest of the year are subject (again) to the elective deferral limits. You can not exceed $23,000 of contributions in the Roth TSP at any time during the calendar year. In addition, if your traditional TSP account has already exceeded $23,000 of contributions during the calendar year, you can’t contribute more taxable pay to it.

If you’re in the BRS, you want to receive DoD’s matching contributions all year. To do that, you must leave room in your Roth TSP for all 12 of your monthly contributions. Read the “If You’re In The BRS…” section below to make your plan.

[See the bottom of this post for the verbatim details of the TSP staff’s interpretation of the tax law.]

If your deployment stretches from October 2023 to March 2024 (ouch, over the holidays), then you’re eligible for the annual addition limit of $66,000/year in 2023 and again for $69,000/year in 2024. Your pay was only untaxed while you were in the combat zone, but you get to use the annual additions limit in two calendar years.

Even if you just have a series of short deployments to combat zones during the year, the IRS will still let you use the annual additions limit all year. You’re certainly paying the price for the benefit– use as much of it as you can.

Note that if you’re stationed in Qatar for two years, you may be able to use the annual additions limit in three different calendar years. “See the world” with tax-exempt pay and higher TSP contribution limits.

- Here’s another method that readers have shared with me: sell some investments from your taxable accounts. You’ll want to seek professional tax advice from a CFP or a CPA, but this can save you a lot on capital-gains taxes.

Here’s the theory: your combat-zone income is tax-free, so your taxable income for the year is very low. When you’re in a low income-tax bracket, your tax rate on long-term capital gains is… zero. For example, a married couple filing jointly pays no capital gains tax if their total taxable income is $89,250 or less.

You’ll raise your TSP contributions (in MyPay or Marine OnLine) as high as possible. Meanwhile, you’d sell some of your investments in taxable accounts (within that 0% long-term capital gains limit) and use that money for living expenses. The net result? You’ve shifted a huge amount of money to the TSP and avoided a whole bunch of capital gains taxes.

- One more idea, although it borders on irresponsibility: if you’re a junior officer who’s taken out a career starter loan during college, then I’d be tempted to maximize my TSP contributions and live off the balance of that loan. You’d essentially be borrowing money at 1%-2% per year to invest in the TSP and then paying it back over a longer term. This is extraordinarily risky (high volatility, loss of principle, leveraged debt) but potentially profitable over a decade or longer.

Let’s cover one more piece of fine print about that annual additions limit, and then we’ll get to the example.

The Roth TSP annual contribution limit is still $23,000

(Even when you’re eligible for the higher annual additions limit)

Here’s that crucial fine print where the TSP computers can cut you off:

Here’s another way of saying it, from page #3 of this TSP fact sheet:

Tax-exempt contributions made to the traditional balance of a uniformed services account while deployed to a designated combat zone do not count toward the tax code’s elective deferral limit. However, any Roth TSP contributions are subject to the Internal Revenue Code limit even if they are contributed from tax-exempt pay.”

When you’re contributing to your Roth TSP (and you should), you must stay below the Internal Revenue Code limit ($23,000) until December’s contribution. This means that your overall annual additions limit will stay just under the elective deferral limit in the Roth TSP (with your last contribution of the year coming in December), and the rest of your contributions will go into the traditional TSP. Of course, the DoD BRS agency/match contributions are always going into your traditional TSP (see paragraph 7.b.(12) of that link), so between you and DoD, you’ll end up with the rest of your contributions in your traditional TSP account.

When your Roth TSP contributions hit $23,000, no matter where you are or when it is during the year, the TSP computer system will cut you off. Any excess contributions from your pay will be used to reach the limit, but the TSP will kick the rest of the excess back to DFAS. Even worse, the TSP will shut you down at the elective deferral limit ($23,000) and lock you out of contributions for the rest of the calendar year.

If You’re In The BRS… then leave room in your Roth TSP for your monthly contributions

[This section is a 12 November 2018 update to the original post.]

We already know that you can only contribute to your Roth TSP up to the elective deferral limit. That limit applies at home and in the combat zone.

The TSP has confirmed that when you’re home from the combat zone, you can only contribute to your traditional TSP up to the elective deferral limit. (See the edits above in paragraph #4, and see the TSP e-mail after the end of this post.)

However, while in the combat zone, you did your best to reach the annual additions limit. ($69,000) That means that you probably contributed way more than the elective deferral limit to your traditional TSP while in the combat zone. If you did, then now that you’re home, the TSP computers would have locked out further contributions to the traditional TSP.

If you’re locked out of TSP contributions before the end of the year, you will lose your DoD BRS matching contributions for the rest of the year. You earned a lot of tax-free pay during the deployment and might have reached the annual additions limit in your TSP, yet you still lost out on free money.

However, you can still contribute to your Roth TSP up to its elective deferral limit of $23,000.

The solution: when you set up your plan for your year of TSP contributions, start with 5% of your monthly base pay to the Roth TSP. That ensures you’ll have 12 months of Roth TSP contributions and 12 months of DoD BRS matching contributions.

Then, fill in the rest of your plan using the spreadsheet template below. When you return home, you’ll probably be shut off from more contributions to your traditional TSP. (You’ve already blown through the elective deferral limit in your traditional TSP, and you’re approaching the overall annual additions limit in your TSP.) However, you still have room in your Roth TSP to reach its elective deferral limit before you reach the annual additions limit.

Example: contributing $55,000 in 2018 to the TSP from a combat zone with the DoD BRS match

Note: The following example was initially published in 2018. For consistency, we have left these numbers as they were in the example provided by correspondence with TSP officials. You will need to update this example with your current situation to maximize your contributions.

This example comes from a series of e-mails with the Federal Retirement Thrift Investment Board (the government agency that runs the TSP) and the DoD BRS office.

This is one of the examples used at the FRTIB for the training of TSP employees, and they’re reportedly working on more comprehensive guidance for servicemembers. I’ve already asked the BRS office to connect us bloggers with the FRTIB so that we can continue the conversation and get specific links to the tax code.

The DoD BRS office also asked me to pass on:

Individual service members who are impacted by this should contact the TSP call center or a tax adviser for guidance on the impacts of IRS regulations on their contributions.”

Until we get Now that we have the IRC references and clarifications from the CPAs and the lawyers, please feel free to refer to this post with the DoD BRS office, DFAS, the TSP, and your pay/personnel office. This example is how the system is supposed to work.

At the end of this example, I’ve included a screen capture of a spreadsheet and a link to the Google Sheet where you can tweak your numbers.

Here’s a scenario for a servicemember who:

- Opted into the Blended Retirement System.

- Contributes at least 5% to their TSP every month (for the full DoD matching contributions).

- Deploys to a combat zone to receive combat zone tax-exempt pay…

- … and their deployment is only part of the year (March – September 2018). They’re back home on 1 October 2018.

Here’s the FRTIB response, edited for easier blog post reading:

I think there are many ways that a service member can do this, and I’ll give an example.

Disclaimer: This is not advice but merely an example of one service member contributing while in a combat zone.

Assumptions:

- Service member who makes $48,000/year in basic pay and receives a $30,000 retention bonus while in a combat zone.

- The elective deferral limit is $18,500 and the annual additions limit is $55,000.

Using these numbers, if the service member contributes 5% in January-February and 5% again in October-December, they will have contributed $200 per month of their own money and received agency/matching 5% of $200 per month.

If that happens, the service member will have contributed $1,000 towards the elective deferral limit (their own contributions) and $2,000 towards the annual additions limit (their own contributions and employer contributions).

That leaves the seven months in the combat zone to figure out how to contribute.

In this exact scenario, it likely makes sense to contribute to Roth up to the elective deferral limit less contributions made in January-February and October-December because those contributions will be tax-free going in and tax-free coming out so long as all of the other tax requirements are met.

In that case, there is $17,500 left towards the elective deferral limit ($18,500 minus the $1,000 contributed in the months while not in a combat zone). That divided over seven months is $2,500 per month of which there will be an additional agency/matching 5% contribution of $1,400.

This brings the total contribution to the TSP to $20,900 meaning the service member can contribute an additional $34,100 of tax-exempt money to their traditional account. That amount over a seven month period is $4,871 per month.

These amounts will allow for both the elective deferral and annual additions limit to be reached and the maximum amount of matching to be reached (5% of $48,000).

Of course, this service member could adjust the numbers to increase the contributions while not in a combat zone and decrease the amount while in a combat zone.

However, if the service member reaches the elective deferral limit before they leave the combat zone, they will not be permitted to make any contributions when they return.

Use a Spreadsheet to Model Your Contributions

As you may have concluded by now, that has to be added to a spreadsheet to be clearly understood.

Here’s the link to that Google Sheet for maximizing BRS contributions to the Thrift Savings Plan from a combat zone. Please note that to edit this spreadsheet, you’ll have to copy it (“File | Download as…”) to your device and then edit your copy.

What If You’re Still In The Legacy High Three Pension System?

The rules are still the same for your combat zone contributions; only you don’t have to worry about DoD’s BRS agency or matching contributions.

Remember to stay below the Roth TSP contribution limit, as mentioned in the BRS section. Here’s another way of saying it, from page #3 of this TSP fact sheet:

Tax-exempt contributions made to the traditional balance of a uniformed services account while deployed to a designated combat zone do not count toward the tax code’s elective deferral limit. However, any Roth TSP contributions are subject to the IRC limit even if they are contributed from tax-exempt pay.”

You have to stay below the IRC limit when you’re contributing to your Roth TSP (and you should). ($18,500 in 2018, $19,000 in 2019.) Your annual additions limit ($55K in 2018, $56K in 2019) will put you just short of $18.5K ($19K in 2019) in the Roth TSP. The remaining $36,500.01 of your contributions ($37,000.01 in 2019) will go into the traditional TSP.

[Reader update:

This comment just came in my Facebook messages:

“Hello, I read your article about maximizing TSP in a combat zone. I ran into an issue earlier in 2018. Before deploying in June, I had contributed about $18,300 to traditional TSP and $200 to Roth. When I arrived I was unable to make any more contributions to Roth, but I was able to contribute to Traditional. Why is this?”

My response:

If you contributed $18,500 to the TSP before deploying, you’d already hit the elective deferral limit ($18,500 in 2018) before arriving in the combat zone. The TSP computers and DFAS would have locked you out of further contributions.

Now that you’re deployed, neither the TSP nor DFAS would have automatically restarted your contributions. Perhaps someone from your pay office (or DFAS) noted your combat-zone status and restarted the contributions. Since you had already reached your annual contribution limit (and they had to turn it back on) for some reason the TSP system wouldn’t accept new contributions to the Roth TSP.

I’m sorry this happened. Servicemembers who’ve opted into the new Blended Retirement System are advised not to front-load their TSP contributions so that they can receive the monthly DoD BRS match all year long. This appears to be a similar issue with the TSP computer system.]

Note for “older” servicemembers

If you’re age 50 or older, then you will be able to include a $6,500/year “catch up” contribution.

You active-duty folks shouldn’t smirk at this clarification– you’d be surprised how many Reserve and National Guard servicemembers are in their 50s. That should tell you something about how challenging & fulfilling the Reserve & Guard can be if you’re feeling a little burned-out on active duty.

A Friendly Little Note From The IRS

[19 December 2018 update: see a sample IRS letter a few paragraphs below, at the end of this section.]

Several servicemembers (and their frustrated spouses) have mentioned receiving IRS letters asking the servicemember to verify their deployment to a combat zone. One family was still receiving IRS letters about a 2016 deployment while the servicemember was deployed again in late 2017.

This letter is automatically generated by an IRS computer, which tries to match the tax return to some sort of report that the servicemember has deployed to a combat zone. (Pro tip: this report to the IRS does not seem to come from DoD.) You’re welcome to call the IRS to confirm, but getting a human to help you respond to the letter is not always easy. I’m not sure an IRS human even sees the letter before it’s mailed to you.

Your best response to the letter 2761 request for your combat zone service dates is a written letter. If you want to be proactive, you can send the letter as soon as you return from deployment. (No operational security issues there!) You can also notify the IRS by e-mail about your combat zone service, but again, I’d wait until you’re home for OPSEC. Spencer over at MilitaryMoneyManual also has more suggestions about documentation and tracking the deployment dates. As he suggests, save copies of your Leave and Earnings Statements which cover the duration of the deployment.

The whole point of volunteering this information to the IRS is to give them your information to create an entry in your taxpayer account database telling the agency that you deployed to a combat zone. That way when your tax return arrives at the IRS months later, the computer will already have a flag in the system to confirm your service. Ideally, it won’t spit out a form letter.

Here’s the IRS’s explanation:

Thank you for your e-mail dated Dec. 10, 2018 and the information you sent in response to a 2761C letter.

The Department of Defense (DoD) is supposed to send us a Combat Zone Indicator (it converts to a Combat Zone Extension in our system) for every member of the military that is in a combat zone. The DoD is also supposed to send us a “spousal” indicator if the military member is married. When the military member exits the combat zone the DoD is supposed to send us the exit date.

This system worked well for a couple of decades. Over the past several years the DoD computer system and our computer system have had communication issues. Sometimes we get no indicator when a military member is in a combat zone, sometimes we get the entrance indicator and not the exit indicator, and sometimes we only get a spousal indicator.

The Internal Revenue Service is tasked with keeping accurate records for all taxpayers. To do so, we sometimes have to ask our taxpayers for help.

We apologize for any inconvenience we have caused you and sincerely thank you for helping us clean up our records.

You may be interested in Publication 3 Armed Forces’ Tax Guide. You can view it on our website or order it through our toll-free forms line at 1-800-829-3676 Mon.- Fri 7:00 am – 7:00 pm your local time.

One more special note: an extended deadline to contribute to your IRA

During my research for this post, I learned that you may even be able to contribute to last year’s IRA. Seek professional advice from a CFP or a CPA before you do this.

Your Call To Action:

Once again, if you’ve opted into the BRS, ensure you contribute at least 5% of your base pay to the Thrift Savings Plan for the BRS match. Even if you’re still paying off debt, it makes sense to contribute to your TSP to at least get DoD’s free money in your TSP.

When you know your deployment dates, download that spreadsheet and make your TSP contribution plan. It’d be great to have the income or assets to reach the annual additions limit but do your best.

Whatever you decide to contribute, make sure you stay below an annual contribution of $23,000 in 2024 in the Roth TSP, or you’ll be locked out of additional contributions for that calendar year. When you’re in the BRS, that limit lockout will keep you from earning DoD BRS matching contributions for all 12 months of the year.

[The rest of the story:

The FRTIB’s policy is not clear in the tax code or in the TSP’s pamphlets and website.

I formed this opinion when an AFC and at least three other CFPs could not find a clear reference to the FRTIB’s policy in the tax code or the TSP’s public materials. (Despite one of them having seen the TSP’s training materials about the limits.) However, two servicemembers were already locked out of further TSP contributions in 2018. We knew they’d followed the rules on their Roth TSP limits. That meant there still could have been a glitch in the TSP computer system’s BRS software or that there’d been another mistake with implementing the legislation. Or… the TSP’s guidance on the annual additions limit was ambiguous.

The FRTIB says that it’s not a computer glitch. DoD’s BRS office (and Congress) can decide whether this is the way they want the TSP to work. There’s already been at least one proposal to change the tax code for Reserve/Guard servicemembers in the BRS who have highly-paid civilian jobs with 401(k) plans. My confusion over the annual additions limit would appear to be yet another unintended consequence of the BRS legislation on TSP contributions.

The good news is that the TSP training team has taken aboard our feedback and is updating their Blended Retirement System training materials. I’ll stay in touch with the TSP and with the DoD BRS office.

Here’s the FRTIB’s verbatim interpretation from one of their TSP Training & Liaison Specialists– one of the people handling the TSP’s Education and Outreach program.

“The answer is “no,” this individual already met their 402(g) elective deferral limit, and therefore would no longer be allowed to make contributions to their TSP (contributions that apply to the 415(c) limit and NOT the 402(g) limit are only CZTE pay contributions, so therefore if you are no longer receiving CZTE pay, any contributions apply to the 402(g) limit, which again, was already met).”

Let me break down that 65-word sentence into smaller clauses.

When you return home from the combat zone, you can still contribute to your TSP accounts– but only up to the elective deferral limit ($18,500 in 2018, $19K in 2019) in each account. The TSP’s website and pamphlets are clear on only being able to contribute combat zone tax-exempt pay above the elective deferral limit in the traditional TSP when you’re in the combat zone. However, they’re not so clear on how you can contribute taxable pay to your traditional TSP after you return home.

One of my smarter friends (a military retiree and a CFP) suggested thinking of it this way: when you’re home, count down from the limits instead of counting up. “How much have I reduced my elective deferral limit in each of my TSP accounts? How much room do I have left to contribute to each one?”

Alert readers will note that the servicemember in the contribution spreadsheet example received a $30K retention bonus while in the combat zone. If they signed that contract in the combat zone, then every one of the subsequent annual installments of that bonus is also tax-free… even if they’re not in the combat zone. Could they contribute the next few years’ installments of that CZTE pay to their traditional TSP up to the annual additions limit?

My answer: I don’t know. I’m going to let the FRTIB and the BRS office clarify those interpretations of the tax code. The good news is that DFAS already knows the bonus contract is tax-free and will reflect it on your W-2.]

Military Guide to Financial Independence

This book provides servicemembers, veterans, and their families with a critical roadmap for becoming financially independent. Topics include:

- Military pension

- TSP

- Tricare Health System

- & More

Comments:

About the comments on this site:

These responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

Todd H says

Doug,

Since dollars contributed in a combat zone are marked as tax exempt anyway (and therefore can be rolled later to a RIRA without ever paying taxes), wouldn’t it be smarter to just switch from whatever regular level of RTSP one was contributing pre-deployment to traditional TSP while deployed?

Then when deployment ends, switch back to RTSP. If dollars contributed to traditional TSP while deployed only count towards the AAL and NOT the EDL, there seems to be zero good reason to contribute to RTSP while deployed. It seems that doing so only complicates things and potentially leaves not enough room in the EDL for remainder of the year after deployment if you do your math wrong (ie inflationary raise in January, time in service pay increase you didn’t anticipate, or a promotion).

Thanks!

Ryan Guina says

Todd,

I can’t speak for Doug, but I’ll share my observations.

Contributing to the Roth TSP in a tax-exempt zone is the best possible situation for investments – the contributions are made with tax free money, it grows tax-free, and withdrawals are tax free. There are no other situations where you can get this in a retirement account.

Traditional TSP contributions made in a tax-exempt zone are made with tax free money, the growth is tax free, but withdrawals are different. Only the contributions can be withdrawn tax-free. The growth is taxed when withdrawn.

Yes, you can transfer the Traditional TSP contributions to a Roth IRA when you leave military service. But you can only transfer the tax-exempt Traditional TSP contributions to a Roth IRA. The growth from those contributions can only be transferred to a Traditional IRA (or you can transfer the growth to a Roth IRA and pay taxes on the growth). To top it off, you may have to wait many years before you are able to transfer the funds. In the meantime, all of the growth from those contributions will be taxable when it is withdrawn in retirement.

The most tax effective way to invest would be to put as much as possible into the Roth TSP without hitting the elective deferral limit, then contributing anything above that to the tax-exempt Traditional TSP. Yes, it requires a lot of planning and there is the risk of making mistakes and missing out on matching contributions or shutting yourself out of the TSP too early in the year. I recommend building a spreadsheet and double-checking your math!

I hope this is helpful!

Chris says

Hi Ryan, how do you decipher what is the combat zone tax-exempt traditional TSP contributions from my non-combat zone non tax-exempt contributions?

Ryan Guina says

Chris, when you are logged into your TSP account, click on the “Contributions” link in the top navigation bar. Then click on “Contribution Balances”. It will show you the contribution balances and earnings for each type: Traditional, Tax-Exempt, and Roth.

When you click the “Nontaxable Balances” section, you will see the amount of your Tax-Exempt and Roth contributions (remember, only your tax-exempt contributions can be withdrawn tax-free; the earnings on your tax-exempt contributions are taxable when withdrawn). I hope this helps!

Pamela Griffin says

Does an individual have to contribute the $20,500 limit to be able to contribute the additional $61,000. Reason for my question is that my client has a civilian employer plan that he wants to contribute the max $20,500 to a 403b. He will be deploying in 2022 and would like to be able to take advantage of the additional $61,000 to his TSP. In order to do so, will he need to NOT contribute to the other plan and just contribute the full $61,000 to his TSP? I understand that the $61,000 max includes employer contributions.

I am thinking that potentially, he can also contribute $61,000 to his 403b as it allows after tax contributions. Thoughts?

Doug Nordman says

Pamela, I’m way outside my circle of competence with 403(b) plans. However if you’re familiar with the differences between 401(k)s and 403(b)s then this post might help:

https://themilitarywallet.com/thrift-savings-plan-contribution-limits/

Note that if your client is in the military Blended Retirement System then they’ll want to make sure they maximize their DoD BRS matching contributions. If they reach the elective deferral limit in their Roth TSP before December then they’ll be locked out of the TSP for the rest of the calendar year. See also Part II of this recent fact sheet:

https://www.tsp.gov/publications/tspfs07.pdf

The TSP has a team of trainers who offer presentations to financial advisors:

https://www.tsp.gov/agency-service-reps/tsp-educational-resources/

I’d contact them and see what other advice they can offer for you.