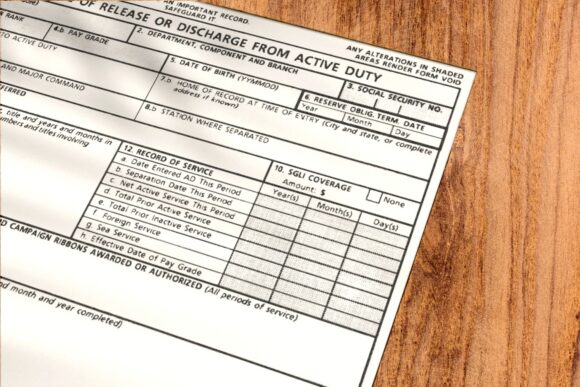

A DD Form-214 is a certificate of release or discharge from active duty issued to US military members upon service completion. It is an official document that summarizes a service member’s military career, including their dates of service, discharge status, and any awards or decorations they received.

Table of Contents

DD Form-214 Example

The DD Form-214 is a one-page synopsis of a veteran’s career. Some of the most important line items include the total number of days of active duty service, authorized decorations, awards, military education and training, and type of separation.

All of these items can be used to help determine your eligibility for certain veterans benefits programs.

This is also why the DD Form-214 is almost always required when applying for veterans benefits programs, veterans preference points for federal service, buying back military service credits for federal service, and more.

What is the DD Form-214 used for?

The DD214 is a critical document for veterans as it serves as proof of their military service and can be used to apply for a range of benefits, including:

- VA home loans

- Education and training programs

- Medical care

- Employment

- Social Security

- Deals and discounts

The DD214 also contains verified information about a veteran’s job specialty, military training, and assignments. It is a valuable resource for veterans and next of kin who want to verify their military service or research their military history.

How to Get Your DD Form-214

The National Personnel Records Center, or NPRC, processes most DD Form-214 requests. Most veterans and their next of kin can obtain free copies of the veteran’s DD Form-214 through the following methods:

- Electronic method. Use the eVetRecs system to create your request.

- Paper method. Mail or Fax a Standard Form SF-180. Print, sign, and date all copies of paper forms before submitting them. Mail the SF-180 to the NPRC at the address below:

National Personnel Records Center

Military Personnel Records

1 Archives Drive

St. Louis, MO 63138

What information do I need for a DD Form-214 request?

Those requesting a veteran’s records must submit basic information so the NPRC can accurately locate them.

Submission information includes:

- The veteran’s name used while in service

- Service number

- Social Security number

- Branch of service

- Dates of service

- Date and place of birth (this is particularly important if the service number is not known)

If you are the next of kin of a deceased veteran, you must provide proof of death. Accepted documents include:

- A copy of the death certificate

- A letter from the funeral home

- A published obituary

It is important to note that a major fire at the National Archives in 1973 permanently destroyed military records for thousands of veterans.

If you need a copy of your records but think the fire may have impacted them, reach out to your local VA so they can submit a request for reconstruction to the NPRC on your behalf. You should have the following information available:

- Location of discharge

- Last unit of assignment

- Place of entry into the service, if known

Check your VA Home Loan eligibility and get personalized rates. Answer a few questions and we'll connect you with a trusted VA lender to answer any questions you have about the VA loan program.

Who Can Request a DD214?

You may request military service records (including DD Form-214) if you are:

- A military veteran

- Next of kin of a deceased, former member of the military. A veteran’s next of kin is considered:

- Surviving spouse who has not remarried

- Father

- Mother

- Son

- Daughter

- Sister

- Brother

- A member of the public requesting records within 62 years of the military member’s release from service.

Limited information may be available to the general public.

How to Replace Your DD Form-214 If Stolen/Lost/Damaged

If you have separated from the military within the last few years, check with your branch of service before the National Personnel Records Center.

If you are unable to receive your records from your branch, you can submit a request through the methods discussed above and check the status of your request via e-mail at [email protected] or by telephone at NPRC Customer Service Line: 1-314-801-0800.

How to Safeguard Your DD Form-214

One of the most important things you can do is maintain the security of your military records. Your DD Form-214 contains your social security number and other personally identifiable information, so keeping your physical copy locked away in a lock box or safety deposit box is recommended. You can also store scanned copies of your DD Form-214 on your computer or cloud backup.

Having multiple copies can help ensure you never lose this essential document.

Avoid Military Records Scams

Most military records are provided by the NPRC free of charge for veterans, next-of-kin, and authorized representatives. If your request involves a service fee, you will be notified by a representative from the NPRC.

Register Your DD Form-214 with Your County or Town Hall

You can register your DD Form-214 with many town halls and county registrars, just like a land deed or vehicle title. Doing this maintains a safely kept record of your service and makes document retrieval quick and easy.

Registering the document with your local government allows them to easily reference your veteran status for access to certain benefits, such as property tax assessments. To maintain privacy, ensure state or local laws do not permit public access to your DD Form-214 before registering it with any office.

Comments:

About the comments on this site:

These responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

tom omalley says

Ryan,

I’m a past member of the USMC Reserves and served 6 years from 1970 to 1976.

My active duty training time was approximately 6 months and I received a dd256 honorable discharge at the end of my service time in 1976.

I live in Connecticut which recognizes 90 days of active service in war time as a qualifier for veteran’s tax relief on personal property but requires a dd214 as documentation.

Can I get a dd214 using my dd256 and training time to justify the issuance of this qualifying document?

Thank you for your assistance.

Brittany Crocker says

Hey Tom, we’ve got a great article on it here: https://themilitarywallet.com/use-dd-form-256-obtain-dd-form-214 . For your dates of service, I would try to request a your DD214 from the National Archives here: https://vetrecs.archives.gov/VeteranRequest/home.html

John Fisher says

How do I obtain a copy of my Form DD 214 in wallet size from the Air Force.

Ryan Guina says

Hello John,

Thank you for contacting me. The military no longer issues wallet-size DD Form 214s. Most veterans choose to obtain an ID Card from the VA, or they get the Veterans Designation on their driver’s license, which is now offered by almost every state.

You can find more information on those options in the following articles:

– Veterans ID Card from the VA

– List of States with Veterans Designation on Drivers License

You might also be able to prove your military service with a membership card to a military organization such as the VFW, American Legion, or a similar service organization. More information on proof of military service.

I hope this is helpful, and thank you for your service!

LoriH says

Hi,

I’m pray someone here sees this soon enough and can answer this accurately.

My husband is a Veteran of Army. He was honorably discharged in 1999. He hasn’t needed his DD-214 until now because we’re 3 weeks away from closing on our home and of course using VA loan. With the pandemic being a thorn in our side he has been able to receive his entire military file from Nat’l archives. Our problem is there isn’t a dd-214 and they’re stating there isn’t a DD-214. He’s called everyone under the sun only to get a “we’ll have to call you back. I’m not sure abiut this one.”

First of all, why can’t the lender use his entire military file until the economy opens back up and he’s able to speak to a live person in regards to getting a DD-214??

Does anyone have ANY suggestions on what to do at this point???

Thanks so much in advance!!

Ryan Guina says

Lori, the VA requires a DD 214 to establish military service and provide a Certificate of Eligibility. The only advice I have is to contact the National Archives, as that is where military records are maintained. I’m not sure where else to obtain a DD 214. I hope you and your husband will be able to work through this. Best wishes!

Joseph Van Horn says

I’m trying to gain some information about my father’s service in the Marine Corps for personal reasons, specifically his ending rank and what type of discharge he received. I have no way of contacting him while he’s incarcerated for things he did between the time he left the Corps and now, so these aren’t things I can ask him about, and after spending my entire life not knowing the man, I’m not sure I could trust anything he has to say; the only reason I believe he actually did serve is because I trust my mother when she tells me stories about having been married to the Corps. I DO know that my father is NOT deceased.

Is there any way I could obtain this information, even if obtaining a copy of his DD214 isn’t possible?

Thank you in advance

Harold Raderman says

I served on active duty in an Army Reserve Unit from Sept ’62-Feb ’63. I received a General Discharge on approximately 1968. Am I eligible for benefits?

Ryan Guina says

Hello Harold, Thank you for contacting me. Each situation is unique and requires a review of your military service to determine benefits eligibility.

The best thing to do is to contact a veterans benefits counselor at the VA, your county VA office, or with a Veterans Service Organization. They have counselors who offer free, individualized claims assistance. They can review your claim, your service periods, medical conditions, and other factors and help you apply for benefits or an upgrade to your current rating.

I wish you the best, and thank you for your service!