Podcast: Play in new window | Download

Subscribe: Apple Podcasts | RSS

Members of the Reserve Component (the National Guard and Reserves) have a different pay and retirement system than Active Duty servicemembers. The Reserve retirement system is set up with the same principles as the Active Duty system, but instead of calculating the retirement based on years of service, it is calculated using Retirement Points.

Understanding how Retirement Points are earned is essential to understanding when you will be eligible for retirement and how to calculate the value of a Reserve pension.

The purpose of this article is to give you an idea of how points are earned and how they are used to calculate your retirement.

Qualifying for a Military Retirement

Before we jump into Points, we need to look at retirement – because the only time Points really matter is when they are used to calculate a “Good Year” of service that counts toward retirement or when they are used to calculate a retirement pension.

In general, servicemembers need a minimum of 20 qualifying years of service to be eligible to retire. Some exceptions exist, such as those who receive a medical retirement or those who are eligible for retirement under the Temporary Early Retirement Authority (TERA). But for this article, we will refer to 20 years as the standard.

Active duty retirees must have 20 years of active duty service to qualify for retirement. This is often referred to as TAFMS time, or Total Active Federal Military Service. An active duty pension starts immediately upon retirement.

Members of the National Guard or Reserves also need 20 Good Years* of service – this can be any combination of qualified service in the National Guard, Reserves, or Active Duty. A Reserve pension generally doesn’t begin until age 60 unless the servicemember qualifies for early retirement based on their active duty time or activations.

*Defining a Good Year in the Guard/Reserves:

A “Good Year” in the Guard or Reserves means the servicemember earned a minimum of 50 Points. Service of less than 50 Points in a given year will not be a Good Year. The Points still count toward retirement, but the servicemember doesn’t get credit for a Good Year.

Earning Annual Participation Points

National Guard and Reserve members earn 15 Points each year they participate in the Guard or Reserves. This includes service in the Regular Reserves or the Individual Ready Reserve (IRR).

The Regular Reserves come to mind when most people think of the Guard or Reserves. This is the “One Weekend a Month, Two Weeks a Year” you probably heard your recruiter or retention officer mention when you joined the military or were out-processing. (Note: While “one weekend a month, two weeks a year” is the common refrain, many members of the Reserve Corps serve many more days than the minimum or serve under a different schedule).

The IRR is the Reserve organization many servicemembers must join when they leave active duty. Almost all initial military contracts are 8-year contracts. If you joined active duty on a 4-year contract, you most likely had 4 years of required duty in the IRR.

For many servicemembers, joining the IRR doesn’t come with any additional duty requirements – the military simply keeps your information on file if they need to do a recall or mobilization. Recalls aren’t common, but they do happen from time to time (for example, it happened to some people in the Post-9/11 era). That said, most people in the IRR never get called back to active duty. However, since they are on the Individual Ready Reserve manning roster, they earn 15 Participation Points per year, even if they don’t do anything else.

Earning Additional Points through Service

Guard and Reserve members earn additional Points through their annual participation. Participation is broken down into Active Service and Inactive Service. Examples of the types of service include:

- Active Service – Active Duty (AD), Active Duty for Training (ADT), and Annual Training (AT)

- Inactive Duty Service – Inactive Duty Training (Paid and Non-Paid), membership, and Non-residential correspondence courses.

Active Service

Members on Active Service are paid active duty rates and benefits and earn one Point for each calendar day they serve in one of these categories. Additional retirement Points cannot be awarded for other activities while in active duty status.

Active Service includes Active Duty (AD), Active Duty for Training (ADT), and Annual Training (AT). AD and ADT days are self-explanatory. This is when the Reserve member is called to active duty, including mobilizing, deploying, training, etc. AT days are the annual two-week training requirement, or the “two weeks a year.” Servicemembers earn one Retirement Point per day while in these statuses.

Inactive Duty Service

Members on Inactive Duty Service can be in a paid or unpaid status, depending on their type of service. The number of Points they earn can also vary depending on the type of service they are performing.

Common Inactive Service Duty includes the weekend Drills, performing in the Honor Guard for Funeral Honors Duty, completing correspondence courses, and other statuses. Drills are a paid status. Serving in the Honor Guard is often an unpaid duty.

Correspondence courses may be paid or unpaid, depending on the course and the availability of unit funds. Correspondence courses also earn the member varying Points, depending on the completed course. Military correspondence courses are normally worth one Point for every three hours of course credit.

Drill Periods

Each Drill Weekend consists of 4 Drill Periods. There is a morning Drill and an afternoon Drill for each day on the weekend, each 4 hours long. Members receive an equivalent of 1 day’s pay for each Drill (Based on 1/30th of the monthly base pay for their pay grade and time in service). They also earn 1 Point per Drill (not to exceed 2 Points per calendar day). So a typical Drill weekend is worth four days of pay and 4 Retirement Points.

Points Breakdown:

- 1 Point for each day on Active Service (AD, ADT, and AT)

- 1 Point per Drill Period (Each Drill weekend normally has 4 Drills, so this is good for 4 Points on a normal Drill weekend).

- 1 Point for serving in an Honor Guard for Funeral Honors Duty (normally capped at 1 Point per day, regardless of the number of funerals in which you serve as an Honor Guard).

- 1 Point for each three study hours of qualifying military correspondence courses.

Keep in mind these are guidelines, and there may be exceptions or other opportunities for earning more Reserve Retirement Points.

Check your VA Home Loan eligibility and get personalized rates. Answer a few questions and we'll connect you with a trusted VA lender to answer any questions you have about the VA loan program.

Retirement Points Earned Per Year

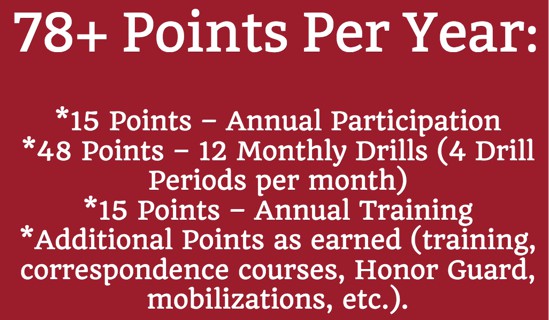

A “normal” year in the Guard or Reserves should be worth approximately 78 Retirement Points. This is broken down as follows:

- 15 Points – Annual Participation

- 48 Points – 12 Monthly Drills (4 Drill Periods per month)

- 15 Points – Annual Training (this can vary based on your unit)

- Additional Points as earned (training, correspondence courses, Honor Guard, mobilizations, etc.).

*Normal is subjective. The math above applies to the standard “one weekend a month, two weeks a year” for a “normal” year in the Guard or Reserves. However, the “normal” year may not apply to everyone. It’s very common to earn more Points, or fewer Points, depending on your specific situation and the needs of your unit.

Maximum Points in a Given Year

The maximum number of Retirement Points a servicemember can earn in any given year is 365 (366 in leap years). This corresponds to serving every day on active duty (or an equivalent number of service Points). You will note that you cannot double dip on Retirement Points and do correspondence courses or other services to earn more than 365 Points in a given year.

By law, there is a cap on the number of inactive duty points that can be accrued for retirement in a given year.

- Reserve year ends on or after 30 Oct 2007: max of 130 Points

- Reserve year ends on or after 29 Oct 2000: max of 90 Points

- Reserve year ends on or after 23 Sep 1996: max of 75 Points

- Before 23 Sep 1996: max of 60 Points

These limits apply to all branches of the military.

Tracking Retirement Points

Your individual Reserve year begins on your Retirement/Retention Year (typically the first day you joined the Reserves) and ends the day before the annual anniversary. For example, I enlisted in the IL Air National Guard on August 07, 2014. My Reserve year runs from August 7, 2014, through August 6, 2015. To qualify for a Good Year, I must earn 50 Points within that period.

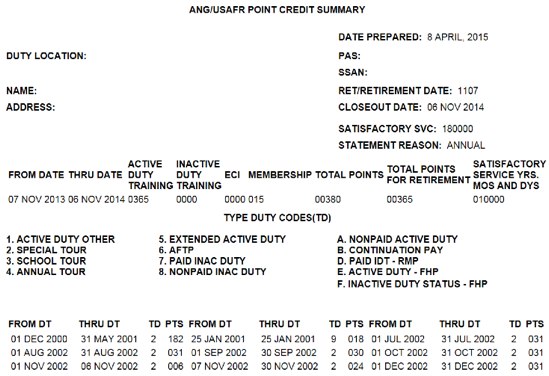

Your parent service should maintain all Retirement Points and can be accessed in your service’s personnel website. It’s a good idea to review these Points regularly to ensure your service is correctly credited. This is highly recommended if you have a break in service, are mobilized or called to active duty, or complete any correspondence or unpaid duty that results in earned Retirement Points. It’s also a good idea to print and maintain copies of your Point Credit Summaries each year to have a physical record.

Here is an example of a Point Credit Summary:

Counting Good Years

As mentioned above, you need to earn 50 Points per year in order to have a “Good Year” that counts toward retirement. This is fairly easy to do as a Drilling member of a National Guard or Reserve Unit. As mentioned above, just doing the standard “one weekend a month, two weeks a year” should be good for around 75+ Retirement Points per year. It’s even possible to miss your entire two-week Annual Training (AT) period and still satisfy the 50-point requirement for a Good Year.

Most members of the IRR won’t earn a Good Year toward retirement unless they served a partial year on active duty or in the Regular Reserves either before or after joining the IRR.

This actually happened to me. I joined the Active Duty Air Force on a 6-year contract, but I extended my contract by 6 months to deploy again before separating. I transitioned into the IRR after I separated from active duty. Those 6 months of extra service on Active Duty earned me approximately 180 Points, in addition to the 15 Participation Points I earned through the IRR. This gave me roughly 195 Points on the year and another Good Year toward retirement.

I finished out another year in the IRR to satisfy the 8-year contract I signed. That earned me another 15 Participation Points. But I didn’t qualify for a Good Year in my final year in the IRR since I didn’t reach the required 50 Points. So my 6.5 years on Active Duty, plus my 1.5 years on the IRR worked out to 7 Good Years toward retirement. (I then had a long break in service before I joined the Air National Guard).

It Takes 20 Good Years to Qualify for a Reserve Retirement

Based on the information above, you should have a good idea of what it takes to qualify for a Reserve retirement. And you can also use this information to make back-of-the-envelope estimations regarding how many Retirement Points you will earn in a given year and how many Retirement Points you will have when you retire (keeping in mind that you may have additional duties, training requirements, and mobilizations that could considerably affect the final numbers).

When I make rough estimates of my potential number of Retirement Points, I start with my active duty service as a base. Then, I add the minimum number of Points I would earn by completing the “one weekend a month, two weeks a year” requirement. Actually, I round down slightly – I use 75 instead of 78, because it’s faster to do the math in my head.

Here is how the Points break down for my service:

- 6 full years of active duty service = 2,191 (there was one Leap Year in there)

- 6 additional months of active duty = 180 points

- 2 years in the IRR = 30 points

- Equals = 2,401

Note: these numbers are before I joined the Air National Guard last year.

Good Years of Service. I have 7 Good Years of service toward retirement based on my Active Duty service. I will soon reach 8 Good Years after I complete my first full year in the Guard. This means I must earn 12 more Good Years toward retirement before I am eligible to retire.

To estimate the Points I will have at retirement, I can take the 2,401 Points that I currently have and then multiply the 75 estimated Points per year by 13 years to get a rough estimate of what I will have at retirement. The reason I use 75 as my estimated number is because 75*4 = 300. Three groups of 4 = 12 good years. So that would be 900 Points. Then add 75 more Points for the 13th year.

The quick math says I will earn approximately 975 more Retirement Points in reaching 20 Good Years of service.

In my situation, I should have roughly 3,500 Points when I reach 20 Good Years of service, provided I only do the minimum each year.*

*This is a very conservative estimate since I used a lower multiplier, and I will likely be required to serve additional days or complete additional active duty training at some point in my service. However, I prefer to estimate things on the low side rather than overestimating the number of Points I will have if/when I reach retirement.

Using Points to Calculate a Reserve Retirement

I mentioned in the opening paragraphs that we would give an overview of how Points are used to calculate a Reserve retirement. I’ll give a very brief overview because this article is already lengthy, and this topic is best served as its own article so we can better explain the nuances of how everything works together. But here is a brief overview:

A Reserve retirement is based on the Points we have discussed throughout this article. For retirement, we can equate 1 Point to the equivalent of one day of Active Duty service.

You can use this information to estimate your Reserve retirement pay.

Under the High-36 retirement plan, an Active Duty retirement is worth 2.5% of your base pay for each year you served (for the High Pay and High-3 retirement plans). For example, a 20-year retirement is worth 50% of your base pay (20 years times 2.5% = 50.0%). Partial years are calculated in a similar manner Months are worth 1/12 of a year, and days are worth 1/30th of a month.

You will use a 2.0% multiplier if you are in the Blended Retirement System (BRS). Members who joined on or after January 1, 2018 are automatically enrolled in the BRS.

The Reserve retirement starts by taking your total number of Points and dividing by 360 (Remember, the military considers a month as 30 days for pay purposes, so each day is worth 1/30th of a month; 12 months would then equal 360 days).

So, if you take my example above of an estimated 3,500 Retirement Points, we would come up with 9 years, 8 months, and 20 days. This would then be calculated against the pay scales to determine the value of the pension (there are also pay scales that show the actual dollar value for each Point, depending on your rank and time in service; these charts can be found in the Guard and Reserve Fact Sheets).

But since I’m fond of using rough estimates when I make my calculations (especially since I am so far away from actually retiring), I would round up to 3,600 Retirement Points before making my calculations. 3,600 / 360 equals 10 years on Active Duty for retirement purposes. Based on this estimate, I can take the 10 years and multiply that by 2.5% and come up with a pension that would be worth roughly 25% of the active duty base pay, based on my pay grade and years of service at retirement.

Again, these are all rough estimates, but for my purposes, it works very well to get a big-picture idea. If you need a more exact reference, you should use the Guard / Reserve Retirement Calculator for your branch of service (most of them are behind login screens on the official military websites, so I don’t have a good link right now).

Did I leave anything out? There is a lot to cover on this topic. Please leave a comment or a question if I missed anything, or if part of this explanation wasn’t clear. I’ll update the article accordingly.

Comments:

About the comments on this site:

These responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

Brian says

I retired from the National Guard into the Retired Reserves. Can I still earn points towards retirement to increase my retirement pay when I reach 60?

Ryan Guina says

Brian, there are very few ways to continue earning retirement points after you officially retire. The most common way I am familiar with is to be reactivated or recalled to duty, or to continue serving for points (extremely rare, but allowed in very limited circumstances with waivers). I recommend contacting your branch’s human resources or personnel office for more information. But don’t be surprised if they tell you it’s impossible or they don’t know what your talking about. Best wishes!

Gwen says

I served in the regular army. Then the Army reserve. And finally a year in the IRR that cut my retirement order. Where can I get a copy of my retirement order? Where can I get a copy of my retirement points? I turned 60 in September of this year. I am trying to get the retirement package together to submit for My retirement pension to start paying me. Thanks Gwen

Ryan Guina says

Gwen, you will need to contact the Army Human Resources Command regarding your retirement order and filing for retirement pay. Best wishes!

Matt Paquin says

Ryan, it would be great to see an article on an AGR retirement and how reserve points get added after 20y of AFS

Ryan Guina says

Matt, that’s a great topic. But I think we can handle it right here. In short, an AGR retirement is the same as an active duty retirement. The member has the same pay and benefits as their active duty counterparts, and the benefits start immediately. Any inactive reserve points are combined and divided by 360 to convert them into months. This time is added to the member’s retirement, just as if they had served those days on active duty.

The main factor to consider is that the member needs to have 20 years of Total Active Federal Military Service (TAFMS) to qualify for active duty (or AGR) retirement. Once they reach 20 years TAFMS, all other points are added at a one-to-one ratio. I hope this is helpful!

Joseph says

Greetings.

I recently retired from Active Duty U S Navy service of 21+ years. I have 6 years of prior guard time from the 80’s. In your experience does any of that time count (drills/basic/correspondence/2 wks, etc.) toward my AD retirement? There appears to be a discrepancy/disagreement on this topic at PERS.

Ryan Guina says

Joseph, you should be able to add all of your Guard retirement points to your active duty retirement. You will need to submit your National Guard records to the Navy personnel office to have them apply that time to your service record. Then, it should be added to your retirement pay. Best wishes!

Keith Carlin says

Hi Ryan,

I am AGR with 8 technician years prior to becoming AGR. I will not have 20 years when I reach age 60. I will be 3 months short of 20 years. I am aware that I could ask for a extension. My question… Is there any benefit to a 20 year Active retirement compared to a reserve retirement base approx. 8000 active duty points? I need to know if I should retire 20 AGR or Reserve. Is there difference?

Daniel Schiff says

I can think of one very interesting loophole that is worth considering. You should consider retiring from the reserves (if you have a 20-year letter) before 60 and taking a civil service position. A reserve retirement falls in a loophole allowing you to collect a reserve pension and a civil service pension as well. With all your active duty years you can likely buy up many years of service towards a civil service pension. If you do so and can get to a total of 20 years of credited civil service, you will also get a 10% kicker on your civil service pension.

https://themilitarywallet.com/earning-military-pension-civil-service-pension/

Pay particular attention to the section: Guard or Reserve Retirement with a Civil Service Pension

Carefully plan and ensure you double and triple check with the AGR Human Resource team to ensure you will have enough good years as a RESERVIST and have your 20-year letter in hand to ensure you do not forfeit your reserve retirement.

Ryan Guina says

Keith, all things being equal, retiring from the Reserve Component (RC) at age 60 is the same as retiring from active duty at any age (retirement pay and healthcare both start at age 60 for RC members). The only difference is how retirement pay is calculated since RC retirement is based on the total number of points, then converted to years of service. But there won’t be any difference for you since you plan to serve until age 60.

That said, some RC members may be better off retiring under the Reserve retirement system if they are eligible for early retirement. This may allow them to begin their retirement pay substantially earlier than age 60, depending on how much qualifying deployment time they have. However, early retirees will have to factor in the cost of healthcare. Tricare doesn’t start for retirees until age 60, regardless of when they begin pulling retirement pay. Members who can afford the increased healthcare costs or who have access to healthcare elsewhere may wish to retire as soon as they are eligible. On the other hand, some may prefer waiting until closer to age 60 to continue working (because they enjoy the challenge, need the income, or need the healthcare).

Take some time to consider your situation. It’s a big decision!