Table of Contents

- Thrift Savings Plan Details

- Defined Contribution Plan

- Tax Deferred Retirement Plan

- Automatic TSP Contributions for New Employees

- Benefits of Automatic Thrift Savings Plan Contributions

- TSP Contribution Limits

- Traditional and Roth TSP Plan Options

- Thrift Savings Plan Investment Options

- G Fund – Short-term U.S. Treasuries

- F Fund – U.S. Corporate Bonds

- C Fund – Large U.S. Companies (S&P 500)

- S Fund – Small U.S. Companies (Wilshire 4500 Index)

- I Fund – International Fund

- L Fund – Lifecycle Funds (Target Date Funds)

- Benefits of Investing in the TSP

- Solid investment choices

- Very low expense ratios

- Tax-free withdrawals are possible in retirement

- Invest your bonuses and special pay

- Matching contributions

- Managing Your Thrift Savings Plan

- Why You Should Participate in the Thrift Savings Plan

The TSP is a retirement savings program for civilians and armed forces members who the United States Federal Government employs. The TSP is very similar to a 401(k) plan in many ways. They are similar because they are both employee-sponsored and defined contribution plans and tax-deferred retirement plans. They also share the same annual contribution limits.

Thrift Savings Plan Details

The Thrift Savings Plan is similar to defined benefit plans, such as a 401k. However, there are a few notable differences.

Defined Contribution Plan

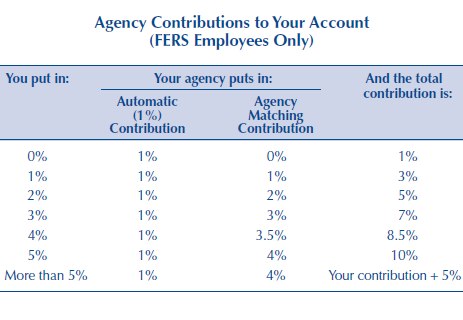

The TSP is a defined contribution plan, which means each TSP participant has an account. The amount in their account is what has been invested by that individual, along with any matching contributions made by their employer. Increases or decreases in the value of the holdings, along with expenses and fees, determine the account’s value. Many civilians employed by the government are eligible to receive matching funds up to 5% of their total pay. Most military members are not eligible to receive matching funds of any kind.

Tax Deferred Retirement Plan

Tax-deferred retirement plans invest money from your paycheck before any taxes have been taken out. This money is then allowed to grow in an investment plan without the drag of taxes affecting the value of the funds. Taxes are assessed on the funds when they are withdrawn as qualified distributions during retirement.

Automatic TSP Contributions for New Employees

Federal employees who are part of the Federal Employees Retirement System (FERS) and were hired after July 31, 2010, will be automatically enrolled in the TSP with an automatic contribution of 3% of their basic pay, which will be automatically deducted from the employee’s pay each period and deposited into the Thrift Savings Plan. This is in addition to the Agency Automatic Contributions of 1% of total base pay and will make employees eligible for Agency Matching Contributions.

Employees can opt-out of automatic plan participation by simply opting out when they are hired. In addition, TSP members can start, stop, or change contributions at any time by using their agency’s or service’s electronic system or by filling out forms TSP-1 (civilian TSP) or TSP-U-1 (uniformed services).

Civilian employees under FERS also have the opportunity to earn make additional Thrift Savings Plan contributions from their base pay to receive Agency Matching Contributions. Civilian TSP members who contribute at least 5% of their basic pay to their TSP account can receive the full amount of agency matching contributions.

Benefits of Automatic Thrift Savings Plan Contributions

Many employers in both the public and private sectors have discovered many people believe that retirement plans are a great idea, but the employees often don’t take the time to sign up for the benefits. Companies that offer automatic enrollment have seen a surge in plan participation, as most people opt to leave the contributions in place. This is a great idea in most cases because automatic contributions make it easy to start saving money.

If you have the opportunity to start investing in the TSP or a similar plan such as the 401k, then go for it. You would be surprised how easily you can adapt to the slightly lower paychecks. Since the contributions are made before taxes, your paycheck decreases by a lower amount than you are contributing.

For example, if you contribute $100 per month, you might only see a difference of $65 in your paycheck because federal and state taxes haven’t been withheld from your contributions. Your TSP contributions will grow without the drag of taxes holding them back until you make withdrawals in retirement age. Overall, this is a simple way to save money for retirement.

TSP Contribution Limits

Note – TSP Contribution Limits: The Thrift Savings Plan follows the same contribution guidelines as the 401(k). The contribution limit in 2024 is $23,000, and those aged 50 or above can make “catch-up” contributions, up to an additional $7,500 per year.

The total amount a member can contribute in any given year is up to $66,000 under the Max Annual Addition Limit (this allows for agency-matching contributions and contributions above the $23,500 limit made in tax-exempt zones).

Here is a full explanation of the Thrift Savings Plan contribution limits, including the agency match for civilian employees, the military matching contributions which will be included in the Blended Retirement System, the impact of making contributions while deployed to a tax-exempt zone, and more.

The following chart shows the TSP agency matching contributions. Note that you can receive up to a 5% match if you also put in the same amount.

Traditional and Roth TSP Plan Options

The TSP allows participants to contribute to a Traditional or a Roth TSP. The difference is how the funds are taxed. Traditional contributions are tax-deductible and give the participant a break today. The funds grow tax-deferred until they are withdrawn at retirement age when they are taxed.

A Roth plan works the opposite way. Contributions are made after the money has been taxed, contributions grow tax-free, and are withdrawn tax-free at retirement age. There are benefits to both plans, so be sure to research which is best for your situation.

After signing up for the Thrift Savings Plan, investments are automatically withdrawn from the employee’s monthly paycheck and invested in the fund of their choice. The default fund is the G Fund. More explanations about the individual funds are below.

Thrift Savings Plan Investment Options

The Thrift Savings Plan has 5 main fund options one can invest in. They are all based on index funds. Index funds are an easy and low-cost way to buy stocks that track a market sector. There is also a 6th fund, the “L Fund,” or Lifecycle Fund, which is a fund comprised of the 5 main funds and allocated for a target retirement date.

Here is a listing of the funds available through the TSP (definitions taken from the fund prospectus, for more information, go to the TSP home page and click on Fund Options):

G Fund – Short-term U.S. Treasuries

The G Fund is invested in short-term U.S. Treasury securities specially issued to the TSP. The U.S. Government guarantees payment of principal and interest. Thus, there is no credit risk. The G Fund offers the opportunity to earn interest rates similar to those of long-term Government securities but without any risk of loss of principal and very little volatility of earnings.

F Fund – U.S. Corporate Bonds

The objective of the F Fund is to match the performance of the Lehman Brothers U.S. Aggregate (LBA) Index, a broad index representing the U.S. bond market. The F Fund offers the opportunity to earn rates of return that exceed those of money market funds over the long term (particularly during periods of declining interest rates), with relatively low risk.

C Fund – Large U.S. Companies (S&P 500)

The objective of the C Fund is to match the performance of the Standard and Poor’s 500 (S&P 500) Index, a broad market index made up of stocks of 500 large to medium-sized U.S. companies. The C Fund offers the opportunity to earn a potentially high investment return over the long term from a broadly diversified portfolio of stocks of large and medium-sized U.S. companies.

S Fund – Small U.S. Companies (Wilshire 4500 Index)

The objective of the S Fund is to match the performance of the Dow Jones Wilshire 4500 Completion (DJW 4500) Index, a broad market index made up of stocks of U.S. companies not included in the S&P 500 Index. The S Fund offers the opportunity to earn a potentially high investment return over the long term by investing in the stocks of small and medium-sized U.S. companies.

I Fund – International Fund

The objective of the I Fund is to match the performance of the Morgan Stanley Capital International EAFE (Europe, Australasia, Far East) Index. The I Fund offers the opportunity to earn a potentially high investment return over the long term by investing in the stocks of companies in developed countries outside the United States.

L Fund – Lifecycle Funds (Target Date Funds)

The Lifecycle Funds diversify participant accounts among the G, F, C, S, and I Funds, using professionally determined investment mixes (allocations) tailored to different time horizons. The L Funds are rebalanced to their target allocations each business day. The investment mix of each fund adjusts quarterly to more conservative investments as the fund’s time horizon shortens. There are 5 different Lifecycle Funds targeting retirement dates through 2050.

While there are not many options to choose from, these options cover most types of major indexes and have very low fees. In 2021, the administrative expenses for all these funds were .043% per year ($0.43 per $1,000). That is very low!

Fewer fund choices also make it easier for investors to begin investing. Studies have shown that too many investment choices in a 401k plan can lead to inaction and cause many investors not to participate.

Benefits of Investing in the TSP

In general, most civil service and military service members are eligible to invest in the TSP. Enrollment is now automatic for most members. Otherwise, it’s as simple as taking five minutes to sign through your HR department or visit the TSP website. Most civil service members receive an automatic matching contribution, and there is nothing members need to do to start the initial match. However, they must make contributions to max out the agency match. Here are some additional benefits to investing in the TSP:

Solid investment choices

The Thrift Savings Plan comprises five basic index funds and a handful of LifeCycle Funds (target date retirement funds), making it easy for the beginner investor. Their index funds mirror popular stock indexes and bond funds.

The stock indexes cover some of the fundamental sectors of the market, including Large Cap stocks (which mirrors the S&P 500 index), Small Cap stocks (which reflect the Dow Jones Wilshire 4500 index), and International Stocks (Morgan Stanley International EAFE Stock Index). The bonds cover government bonds (generally the most stable) and fixed securities, which aren’t guaranteed like government bonds but often have a greater return on investment.

The TSP also uses target date funds for those who want to invest with a less hands-on approach. The target date funds, called LifeCycle Funds, are comprised of a mixture of the above stocks and bonds and are automatically allocated by your target retirement date, adding more fixed income investments to the mix the closer you get to retirement.

Very low expense ratios

The Thrift Savings Plan has some of the lowest expense ratios I’ve ever seen for any form of an index fund – often even lower than companies such as Vanguard and Fidelity. The highest management fee is currently .05%, which includes the LifeCycle Fund investments (most mutual fund houses charge much more than this for a target date fund investment).

Tax-free withdrawals are possible in retirement

Yes, it’s true! The TSP recently added a Roth TSP option, but it was even possible to receive tax-free withdrawals before the Roth option was available. Military service members who contribute to the TSP while deployed can make contributions with tax-exempt income. Since Traditional TSP contributions are made with pre-tax money, the TSP tracks these tax-exempt contributions, and members can withdraw them on a prorated basis with their regular TSP withdrawals.

It’s important to note that only the contribution is eligible to be withdrawn tax-free, as it isn’t possible to track the earnings from that contribution. Tax-exempt contributions are tracked on your TSP balance sheet – look for a line that states “Tax Exempt Balance – $xx,xxx.xx.” You can learn more about tax-exempt TSP contributions and withdrawals.

Invest your bonuses and special pay

Military members can invest all or a portion of their bonuses and special duty pay to their TSP, up to the annual contribution limit. Eligible pay and bonuses include things such as your special duty pay, retention bonuses, Hostile Fire Pay, Hazardous Duty Pay, and some other bonuses.

Matching contributions

Military members who joined after 2018 and civil service employees automatically receive a contribution to the TSP when they join the civil service. Still, they can earn more money by making larger contributions – up to 5% of their salary (up to the contribution limits).

Before 2018, the military did not offer a matching contribution for military members, with limited exceptions (a trial basis used as a retention tool; this was not widely available).

The military launched the Blended Retirement System (BRS) in 2018. The BRS offers a reduced pension in return for matching TSP contributions. All members who join the military after Jan 1, 2018, are automatically enrolled in the BRS.

Managing Your Thrift Savings Plan

Managing your TSP is easy if it is your only investment account. Otherwise, you will need to consider your entire portfolio before making changes to your TSP. Consider your TSP, employer-sponsored retirement accounts such as 401k, Roth and Traditional IRAs, and taxable investment accounts.

As you can see, managing your TSP is easy when you are starting, but it can quickly become complicated.

I use a free online software program, Personal Capital, to help manage my investments. Personal Capital makes it easy to link your investment accounts and see an overview of all your investments in one location. Their free tool also analyzes your asset allocation, which you can use to rebalance your portfolio. It is a very powerful tool!

Learn more about managing your Thrift Savings Plan, including screenshots and advanced tips.

Why You Should Participate in the Thrift Savings Plan

The TSP is a great way to invest in retirement. It offers sufficient investment options for a well-diversified portfolio, and civil service members receive a generous match of up to 5% of their pay. Service members under the High-3 or previous retirement plans are not eligible for matching contributions. However, the Thrift Savings Plan is a key component of the Blended Retirement System. TSP participants under the BRS will receive the same matching limits as their civilian counterparts, up to 5%.

The Thrift Savings Plan also offers extremely low management fees, even lower than industry leaders like Vanguard, Fidelity, and Charles Schwab.

But the best reason to participate in the TSP is you. You are in control of your financial future, and the TSP is one tool you can use to make that future better. I encourage everyone eligible to participate in the TSP to do so, even if they plan to remain in the military until retirement. Military retirement pay is awesome, but having a little extra money never hurts when you reach retirement age.

Thrift Savings Plan Podcast Episode: I love the TSP so much that I had a guest on our podcast to discuss the benefits of investing with the TSP. It’s a great overview of how the TSP works and why eligible members should participate. This was the first podcast I recorded, and I did have some technical issues, so go easy on the quality! Listen to the TSP Podcast Episode.

Comments:

About the comments on this site:

These responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

Cynthia Spencer says

I’m locked out of my TSP Account and I’m getting a hard time trying to access my account. After my house was broken into my information concerning this account was stolen and possibly money taken. Not only money taken false income tax filed. Request assistance.

Ryan Guina says

Cynthia, I’m sorry to hear about this! You will need to file a police report regarding the theft and contact the Thrift Savings Plan customer support line.

cynthia spencer says

Thanks Ryan for replying. I need access to my account. Can you help me with gaining access to my account.

Ryan Guina says

Cynthia, you will need to contact the TSP customer support center to get help accessing your account. They are the only ones who can help. Best wishes!