The Military Wallet: Helping the Military Community Manage Money

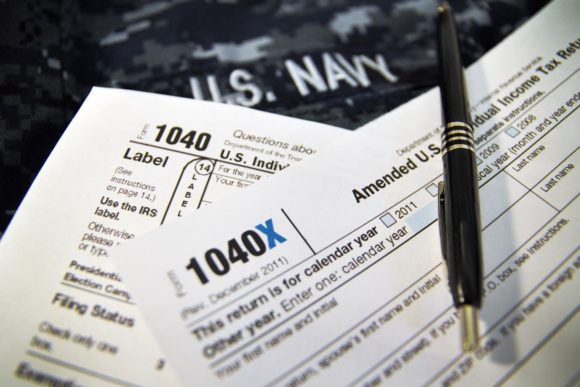

Military Tax Tips: Common Military Tax Situations and Mistakes

Military members and their families often have unique tax situations. These tips can help you prepare your taxes and ensure you get the largest tax refund possible.

Is Cryptocurrency Taxed? A Guide to Taxes on Virtual Currency

Cryptocurrency investors must pay capital gains taxes on investments. Miners may also be subject to self-employment taxes. Here’s what the IRS expects regarding cryptocurrency and taxes.

Military Tax Tips: Common Military Tax Situations and Mistakes

Military members and their families often have unique tax situations. These tips can help you prepare your taxes and ensure you get the largest tax refund possible.

We Can Help You With:

Latest Articles

MoreVA Loan Rates – Compare Today’s VA Home Loan Rates

VA loan benefits include $0 down payment, no PMI and borrower-friendly credit requirements. Beyond that, VA loan rates are incredibly competitive, unlocking the potential to own a home for millions of military personnel and veterans.

VA Cash-Out Refinance Guidelines 2024

The VA cash-out refinance program allows Veterans to leverage home equity into cash, offering up to 100% borrowing against appraised home value for various needs.

Zales Military Discount On Diamonds and Jewelry

Zales offers a 10% military discount on purchases to current members of the U.S. armed forces, as well as veterans and retired military personnel.

Our Favorite 2024 Military Discounts

The best deals and discounts RIGHT NOW for our readers.

Most Popular Articles

2024 VA Service-Connected Disability Rates

VA service-connected disability compensation rates will increase 3.2% in 2024. Here are the current VA disability compensation rate tables.

Types of Military Discharges – Understanding the Difference

There are many types of military discharges, including an honorable military discharge, general discharge, under other than honorable conditions, bad conduct discharge, dishonorable discharge, and entry-level separation. This guide explains the difference among these types of …

Home Depot Military Discount – How to Save 10% on Purchases at Home Depot

Home Depot offers a 10% military discount year round to military members, veterans and military spouses. The policy changed a bit in 2022. Here’s what you need to know about enrolling in the program, your virtual …

2024 IRS Tax Refund Schedule (2023 Tax Year): When Will I Receive My Tax Refund?

The 2024 tax refund schedule for the 2023 tax year starts on January 29th. Our tax refund chart lists the federal tax refund dates for direct deposits and mailed checks.