The Military Wallet: Helping the Military Community Manage Money

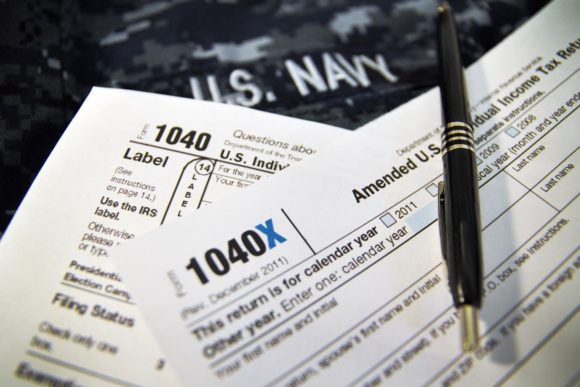

Military Tax Tips: Common Military Tax Situations and Mistakes

Military members and their families often have unique tax situations. These tips can help you prepare your taxes and ensure you get the largest tax refund possible.

Is Cryptocurrency Taxed? A Guide to Taxes on Virtual Currency

Cryptocurrency investors must pay capital gains taxes on investments. Miners may also be subject to self-employment taxes. Here’s what the IRS expects regarding cryptocurrency and taxes.

Chase Sapphire Reserve – How to Apply

Explore the Chase Sapphire Reserve military application process, its features, and its value for Veterans and service members under the SCRA/MLA.

We Can Help You With:

Latest Articles

MoreVA Loan Rates – Compare Today’s VA Home Loan Rates

VA loan benefits include $0 down payment, no PMI and borrower-friendly credit requirements. Beyond that, VA loan rates are incredibly competitive, unlocking the potential to own a home for millions of military personnel and veterans.

Chase Sapphire Reserve – How to Apply

Explore the Chase Sapphire Reserve military application process, its features, and its value for Veterans and service members under the SCRA/MLA.

2024 Memorial Day Military Discounts

2024 Memorial Day Discounts: Many organizations, restaurants and retailers honor our country’s military members and veterans with military discounts.

VA Cash-Out Refinance Guidelines 2024

The VA cash-out refinance program allows Veterans to leverage home equity into cash, offering up to 100% borrowing against appraised home value for various needs.

Most Popular Articles

2024 VA Service-Connected Disability Rates

VA service-connected disability compensation rates will increase 3.2% in 2024. Here are the current VA disability compensation rate tables.

Types of Military Discharges – Understanding the Difference

There are many types of military discharges, including an honorable military discharge, general discharge, under other than honorable conditions, bad conduct discharge, dishonorable discharge, and entry-level separation. This guide explains the difference among these types of …

Home Depot Military Discount – How to Save 10% on Purchases at Home Depot

Home Depot offers a 10% military discount year round to military members, veterans and military spouses. The policy changed a bit in 2022. Here’s what you need to know about enrolling in the program, your virtual …

2024 IRS Tax Refund Schedule (2023 Tax Year): When Will I Receive My Tax Refund?

The 2024 tax refund schedule for the 2023 tax year starts on January 29th. Our tax refund chart lists the federal tax refund dates for direct deposits and mailed checks.