Table of Contents

- How To Calculate A Reserve Retirement

- A Quick Overview of How Active Duty and Reserve Retirement is Calculated

- More Details on Guard & Reserve Retirement Points

- Earning Annual Participation Points

- Earning Points For Service

- The Four Hour Rule

- Two-Hour Rule

- Doing the Math: Calculating Reserve Points

- What Is A Good Year?

- Retire Awaiting Pay, or Resign?

- Final Pay, High Three, or Blended Retirement System?

- Starting Retired Pay Before Age 60

- What is the Average Military Pension After 20 years?

- Want More Answers?

Note: Calculating retirement pay for the Guard and Reserves is slightly different from determining active duty retirement pay. This guide will show you how you can calculate your retirement pay. Note: This article uses data from the 2016 pay scale. However, the concepts are the same regardless of your pay grade or current pay scales. Simply plug in your current pay to these formulas to reach your anticipated Reserve retirement pay.

How To Calculate A Reserve Retirement

I recently answered a couple of questions on calculating the amount of a Reserve retirement for both Final Pay and High Three pay systems.

If you’re eligible for a Guard – Reserve retirement, then let me repeat the questions & answers so that you can confirm your math.

A Quick Overview of How Active Duty and Reserve Retirement is Calculated

Some of the processes are the same for calculating active duty and reserve retirement amounts. However, there are some notable differences.

In both instances, a retiree can use the Final Pay Plan or the High-36 Month Average Plan. Active duty retirement can also be calculated using the REDUX Plan.

- Final Pay is used for service members who first entered the military before September 8, 1980.

- The High 36 Plan is used for service members who first entered the military between September 8, 1980 and July 31, 1986.

- The REDUX Plan is available only to active duty members who entered service on or after August 1, 1986.

The biggest difference between active duty retirement and reserve retirement is when you can file. Active duty service members can file when their military career ends and they have accumulated 20 years of service. Technically, this means is someone enlists at age 18, they could start drawing retirement as early as age 38. By contrast, a reservist can only file for retirement when they turn 60, with a few exceptions, such as qualifying for early Guard/reserve retirement.

The other big difference is that active duty retirement is based on years of service while reservist retirement is based on an accumulation of points which are then converted to years of service.

In all cases, the Retired Pay Formula is determined by multiplying your retired pay base by a service percentage:

Retired Pay Base x Service Percent Multiplier = Gross Retired Pay

Gross retired pay is rounded down to the nearest dollar.

Next, each year of active duty service is worth 2.5% toward your service percent multiplier (2.0% for those participating in the Blended Retirement System).

So the longer you stay on active duty, the higher your retirement pay. For example, a retiree with 20 years of service would receive 50% of their base pay (20 years x 2.5%). A retiree would receive 75% of their gross pay after 30 years of service (30 years x 2.5%). Retirement maxes out at 75% of gross retired pay.

A retired reserve member converts points to active service equivalents by dividing those points by 360. For example, 7200 retirement points divided by 360 = 20 years of active duty service (2.5% x 20 years = 50%).

Until recently, the Final Pay Plan and High-36 Month Average Plan were the two primary non-disability retirement plans in effect for qualified reservists. However, reserve members also became eligible for the Blended Retirement System effective Jan. 1, 2018. The Blended Retirement System does not change how retirement points are calculated for members of the Reserves, with the exception of using a 2.0% multiplier.

For disability retirements, you would receive 2.5% for each year of service, or a disability percentage assigned by the service at the time you retire. In either case, the multiplier is limited to 75% by law. This article explains how disability compensation impacts your retirement pay.

More Details on Guard & Reserve Retirement Points

The following section goes into greater detail on earning retirement points in the Guard and Reserves. This is a good general overview. For a more in-depth article, check out this Guard and Reserve Points Guide. It goes into more detail and includes a podcast discussing the ins and outs of earning points in the Guard and Reserves.

When you’re in the Reserves or Guard, your time toward retirement is credited on two factors:

- the number of points you build up

- the number of “good years” you’ve completed

Each service is a little different in its point calculations. Points accumulate from both active duty and the Reserve/Guard system.

Earning Annual Participation Points

15 retirement points are awarded to Guard and Reserve members for each year of service. This includes times spent as a drilling participant or while serving in the Individual Ready Reserve (IRR).

A drilling participant is a member of a Reserve component who regularly serves a minimum of one weekend per month and approximately 14 days a year during annual training (AT). While their IRR counterparts, serve in inactive status after completion of active duty or electing to transfer into the component.

Thanks to Reservist and CFP Jeff Clark for researching the history of participation points. It’s discussed on page 164 of the 11th Quadrennial Review of Military Compensation. It’s the inset box which includes the text “Unfortunately, no documentation was available to explain the purpose or rationale for the 15 membership points. However…”

Earning Points For Service

You accumulate points for drill weekends, active duty periods, and under some special circumstances:

- completion of online or correspondence courses

- serving on funeral honors detail

- providing support to recruiting personnel

Each day of active duty counts as one point. Each drill counts as one point (a typical weekend has four drills), as do the days of active duty in the Reserve/Guard for training or mobilizations.

You’re also limited by the number of points you can get in a category — you can’t do 52 drill weekends in one year and get points for every one.

Of course, you can certainly be mobilized during a leap year and receive 366 points of active duty.

Here’s a minimum breakdown of points earned during a normal year:

- Annual Participation – 15

- Monthly Drills – 48 (12 months x 4 drills)

- Annual Training – 15

- Total points +/- 78

This article covers ways to earn more retirement points in the Guard and Reserves beyond the traditional “one weekend a month, two weeks a year“.

Note: It’s possible to get points for other purposes, but they’re limited. (For example, it was previously possible for officers commissioned from NROTC to receive points for the days they were on active duty for midshipman summer training, but they’ll need to supply the documentation. This niche benefit has since been revoked).

https://www.mynavyhr.navy.mil/Career-Management/Retirement/Officer-Retirements/Midshipman-FAQs/

The Four Hour Rule

During Inactive Duty Training (IDT), one point will be awarded for each 4-hour period of IDT performed.

A maximum of two points per calendar day applies to IDT Duty. Duty must be 8 hours in duration to receive two points per day.

Meetings (Seminars, Symposia, Professional Development). Per DoD Instruction 1215.07, members will only be allowed one point per day. Each training period must be a minimum of 4 hours in length.

Two-Hour Rule

Per DoDI Instruction 1215.07, the Funeral Honors requires a minimum of two hours of duty. Members receive one point for each day and the duty must be a minimum of 2 hours, including travel.

Doing the Math: Calculating Reserve Points

Reserve members can log a qualifying year for each year they earn at least 50 retirement points.

Inactive point credits are earned for inactive duty training, reserve membership, equivalent instruction, and correspondence courses.

The following point credits apply:

- Up to 60 inactive points for retirement years that ended before Sep. 23, 1996

- Up to 75 inactive points for retirement years ending on or after Sep. 23, 1996 and before Oct. 30, 2000.

- Up to 90 points in the retirement year that includes Oct. 30, 2000 and in any subsequent year of service.

Points from these sources may be added to points earned from active duty and active duty for training for a maximum total of 365 or 366 points per retirement year.

Points are credited as follows:

- One point for each day of active service (active duty or active duty for training).

- 15 points for each year of membership in a Reserve Component.

- One point for each unit training assembly.

- One point for each day in which a member is in a funeral honors duty status.

- Satisfactory completion of accredited correspondence courses at one point for each three credit hours earned.

Reserve members with 20 or more years to begin drawing retirement benefits before age 60 if they deploy for war or a national emergency. For every 90 consecutive days spent mobilized, members of the reserves will see their start date for annuities reduced by three months. However, because this was based on a law passed in 2008, it only applies for deployment time served after Jan. 28, 2008.

What Is A Good Year?

A “good year” ensures that you show up each year for a certain minimum amount of work. A good year is defined as one in which you earned a minimum of 50 points.

This can be accomplished if you show up for drills on at least 10 of the 12 months (or complete enough other assignments), then you’ve met the intent of a good year.

To be credited with a good year, you must earn a minimum of 50 points within 12 months (your retention year) and maintain your mobilization readiness (like completing the medical checklists).

This status is tracked in your service’s Reserve/Guard databases, and you may be issued occasional updates. Every year you can earn a certain number of points and get a “good year.” However, you’ll still have to verify that your service correctly credits you with that accomplishment.

You’re considered eligible for retirement when you’ve completed 20 “good years” of service. (But of course, you can usually choose to continue to serve.) If you have a combination of active duty and Reserve/Guard duty, then your active-duty service time counts toward the 20 good years.

There are also special circumstances (mainly medical) when you may be eligible to retire before reaching 20 good years. However, for purposes of this post, we’re going to assume that your retirement eligibility is based on the main requirement of 20 good years.

When you reach 20 good years, your service will eventually formally notify you that you’re eligible for retirement. (You may still have to finish other obligations like an enlistment, a minimum time in rank, or a set of orders.) When you complete those requirements (or have them waivered, or agree to retire at a lower rank), then you can apply for retirement.

The key to your retirement is that “notice of eligibility,” more commonly called “the 20-year letter.”

Retire Awaiting Pay, or Resign?

There are two ways to retire, and they require you to consider a certain amount of risk. The first option is to “retire awaiting pay”. Over 99.99% of Reserve/Guard retirees choose this option. When you retire awaiting pay you’re not required to perform any duties or maintain any readiness in the “gray area” between the time you retire and the start of your retired pay, but the risk of this option is that you could still be recalled to duty for a full mobilization.

A full mobilization requires the President and Congress to declare a war that’s bad enough to require the entire armed forces, and it’s more severe than the Presidential mobilization that was declared after 9/11.

Most Reserve/Guard retirees are willing to take this risk because the Department of Defense pays for it. If you retire awaiting pay then your seniority within your rank continues to accumulate, and when you reach your pension start date (generally age 60) then your retirement pay will be drawn at the active-duty pay table in effect that year. In other words, DoD covers you on both seniority and inflation.

You may also want to read the: Reserve Non-Regular Retirement Information Guide

If you’re not willing to accept the risk of a full mobilization, then the only way to completely avoid it is to resign. You’ll still receive your pension at your start date (generally age 60) but it’ll be at the seniority you had in that rank when you resigned– and in the pay scale in effect when you resigned.

This may not be much of a difference if you resign at age 59, but if you resign at age 37 then you’ll be facing over two decades of inflation erosion before your pension starts.

For the purposes of this post, we’re going to assume that you “retire awaiting pay”.

Final Pay, High Three, or Blended Retirement System?

The next question is whether you’re retiring under the pay base system of “Final Pay, “High Three”, or the Blended Retirement System (BRS). Both of them depend on the “Date of Initial Entry into Military Service” or “Date of Initial Entry into Uniformed Service”.

For most servicemembers, it’s considered the day that you first raised your hand, took the oath, and received an ID card. If your DIEMS/DIEUS date is before 8 September 1980 then you’re Final Pay. Otherwise, you’re “High Three”. If you joined the military with a DIEMS/DIEUS date after 31 December 2017, you’re in the BRS.

One loophole to this involves commissioned officers. If your commissioning source was a service academy, then your DIEMS date is the date you started at the service academy. However, when the services consolidated their pay systems in the 1990s, some members of the service academy classes of 1981-1984 were not properly credited with the correct DIEMS/DIEUS date. If you’re one of the few in this situation then make sure that your date is before 6 September 1980.

In addition, if you started at the service academy or signed an ROTC scholarship agreement before 31 December 2017, then when you commission you can opt into the Blended Retirement System.

Once you determine which retired pay base system you’re under, you’re ready to calculate your service percent multiplier.

The Service Percent Multiplier

If you had retired under the active-duty system with Final Pay or High Three, your multiplier would have been 2.5% per year of service. For 20 years of service, this is the “50% of base pay” that you’ve seen so much in the media.

Members who retire under the Blended Retirement System will use a 2.0% multiplier, which equates to 40% of your base pay at 20 years.

The Reserve/Guard retirement system calculates the multiplier from your total points.

Divide your grand total career point count by 360 (because your pay is based on 30-day months) and multiply by 2.5% (or 2.0%) to come up with your service multiplier.

For example, 2134 points / 360 * 2.5% = 14.82%. That’s your service percent multiplier, just as an active-duty retirement at 20 years would be 50%.

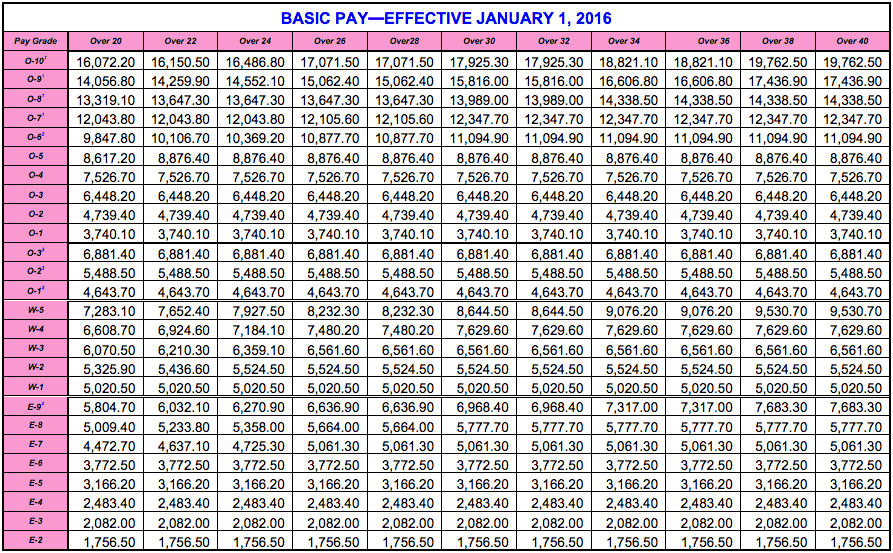

Pay Scale

Now you need your pay scale. If you “retired awaiting pay”, then your pay scale is on the pay table at the maximum longevity for that rank during the year that you turn age 60. (A few Reserve/Guard veterans may be eligible to begin receiving their pension earlier than age 60. We’ll get to that near the end of this post).

The problem with this calculation is that Reserve/Guard members who “retired awaiting pay” have to wait until they turn age 60 to know exactly what amounts are on that pay table. (If you’re only 38 years old when you retire, then you’d have to wait nearly 22 years to find out.)

The only suggestion I have for this situation is to assume that your pension will keep up with the current pay tables.

In specific terms, you’re assuming that military pay maintains pace with the Employment Cost Index. For a spreadsheet or a calculator, you could assume that military pay grows with the rate of inflation. This is not a very accurate assumption but it’s the best available for calculating future dollars.

A better assumption would be to convert your retirement income and expenses to today’s dollars and use today’s pay table. Take a look at the second page of the 2016 pay table.

If you retired as an O-6, there are pay longevity raises at 20 years of service, 22 years, 24 years, 26 years, and 30 years. It tops out at 30.

If you retired as an O-6 awaiting pay then you’d choose the maximum pay of that rank. In this case, an O-6>30 or $11,094.90/month.

If you retired as an O-5 then it’d be $8,876.40. At E-7 it’d be $5,061.30.

The Final Pay Pension

Whatever max pay you find for that rank, multiply it by the service percent multiplier and round it down to the nearest dollar.

That’s your monthly pension.

For an E-7 with 2134 points starting their pension in 2016 it’d be $5061.30 * .1482 = $750/month.

The High Three Pension

That’s a messier calculation.

Here’s what the Association of the U.S. Navy website says about High Three Reserve retirement in one of their articles (Note: the article is behind a membership login):

This system applies to anyone with a DIEMS of 8 September 1980 to present. Retired pay is calculated based on a figure derived from the average of the last 36 months of basic pay for the approved retired grade (highest grade satisfactorily held), and from the length of service (longevity) prior to reaching age 60. In other words, it is the basic pay in effect when you were ages 58, 59, and 60. The percentage of that figure (36-month average) you will receive is calculated by dividing your total points by 360 and multiplying that figure (equal to years and months) by 2.5 percent.

So you still start with your total points, divide by 360, and multiply by 2.5% to get the service percent multiplier.

Note that the multiplier is 2.0% for the Blended Retirement System.

But then the pay calculation is painful. You have to have 36 months of pay charts (the years you turn ages 60, age 59, age 58, and age 57). For each one, you’ll take the max pay at that rank (max longevity) and the number of months of that year. Then you’ll add them all together and divide by 36.

Here is an example:

Let’s say you turn age 60 in June 2012. You’d use six months (January-June) of pay for that rank at the max longevity in the 2012 pay table. For a High Three E-7, that’s $4815.90/month * 6.

Then you’d use 12 months of max pay for that rank in the 2011 pay table: $4740.00 * 12.

You’d add another 12 months of max pay for that rank in the 2010 pay table: $4674.60 * 12.

Finally, you’d add another six months of max pay for that rank in the 2009 pay table: $4521.00 * 6.

Now that you have the final 36 months of pay, you add all those numbers up and divide to get the final average monthly high-three pay:

($4815.90 * 6 + $4740.00 * 12 + $4674.60 * 12 + $4521.00 * 6) / 36 = $4694.35.

Note that it’s 97.5% of the Final Pay amount– only a 2.5% reduction.

That base pay number is multiplied by the service multiple to get the monthly pension amount.

$4694.35 * .1482 = $695/month.

Seems like a lot of work to shave 2.5% off your pension, but “high three” is commonly used in today’s defined-benefit pension systems to avoid the employee syndrome of “pension spiking”, a final year of work with exceptionally high pay. Congress and DoD just took advantage of a common civilian practice that doesn’t happen to be common to the military.

AUSN’s website doesn’t even have a calculator for the High Three Reserve retirement. They have a “Contact us” form that you fill out with the pertinent data, and then AUSN’s staff calculates the pension amount by hand.

By the way, if you join AUSN you’ll have access to all their website tools for Reserve planning, including the latest on when you’ll hear from your service and the pay center. You’ll be able to use their calculators and their guides on the Survivor Benefits Plan and their articles on retiree taxes. For a fee, AUSN will even review your record to determine how much you’ll be getting and what steps to take. I haven’t researched the question, but the other services should have similar Reserve/Guard advocacy organizations with similar support.

Starting Retired Pay Before Age 60

Some Reserve/Guard members may actually be eligible for a retirement earlier than age 60. The current legislation (passed in early 2008 and updated in 2015) reduces the age 60 retirement requirement by three months for every 90 consecutive days of mobilization during a fiscal year for war or national emergency.

In other words, a Reservist volunteering to deploy to the desert for a fiscal year would be eligible to start their Reserve pension at age 59.

A member of the National Guard who deploys with their unit for 24 months of the next five years (at least 90 days in the fiscal years) would be able to draw their pension at age 58. But this law only applies for deployment time served after Jan. 28, 2008.

Several amendments have been proposed to retroactively extend this benefit to September 11, 2001, but none of these modifications have yet been approved by Congress. There hasn’t been much support to this point, so don’t expect this will be made retroactive any time soon (if at all).

What is the Average Military Pension After 20 years?

This is a lot like asking how much a car costs. As an example, for retirement purposes, 20 years is the minimum qualifying level, but many service members serve additional years. The Department of Defense uses a multi-step formula to compute retirement benefits pay, so there is no single accurate answer when it comes what the average reserve retirement pay is.

The only way to address this question is to consider your individual circumstances. You need to consider these factors as a starting point:

- How many years did you serve both active duty and as a reserve member?

- Which years did you serve?

- What was your rank at retirement?

- Are there questions related to how a Social Security benefit and a federal retirement benefit interact with each other?

- What were your earnings that have an impact on how your retirement pay is calculated?

- Which formula applies to you?

- Does military disability enter into the picture?

- How about Extraordinary Heroism Pay?

Want More Answers?

If you have questions about either active duty or reserve member retirement plan benefits, contact the appropriate Defense Finance and Accounting Service (DFAS) office:

- Air Force, Army, Marine Corps, Navy, Space Force active duty or Reserve, call 1-888-332-7411.

- Retiree, survivor, or beneficiary, call 1-800-321-1080.

Military Guide to Financial Independence

This book provides servicemembers, veterans, and their families with a critical roadmap for becoming financially independent. Topics include:

- Military pension

- TSP

- Tricare Health System

- & More

Comments:

About the comments on this site:

These responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

S.P.Denham says

Hello I am due to start receiving my reserve pay which is estimated to be 1300 a month. However I currently receive a 30% disability payment of $650 monthly. How will that disability affect how much I get from my reserve pay. An estimate would be nice..

Ryan Guina says

S.P.,

I don’t have a lot to go on by your comment. If you are a retiree, your military retirement pay will be offset by your VA disability compensation. You can read more about how VA disability impacts retirement pay in this article.

If you are currently serving, I encourage you to read the following two articles to get a better idea of how a VA disability rating impacts your ability to serve in the Guard or Reserves, and how to determine whether to waive military or VA compensation for the days you served in both statuses.

Regarding serving with a VA disability rating: you can only earn one type of pay on any given day. You can’t earn VA disability compensation on the same day you earn military compensation. Because there is no way for the VA to track this in real-time, you will receive a form each year outlining the days that you received compensation for both payments. You will then need to choose one to waive. These benefits are pro-rated based on the monthly compensation rate. In almost every case, it is best to waive the VA disability compensation. If you choose to do so, the VA will withhold a portion of future payments until you have repaid the debt. The above article outlines the details.

Best wishes!

Dean O says

Aloha Doug,

Is there a difference between your TAFMS and PCARS when retiring? An Air National Guardsmen had 4 yrs Active duty, spent the next yrs as traditional Guardsmen then got an AGR IN 2023.

At this point he accumulated 12 yrs of TAFMS and around 5400 points (15 yrs). Say he works 8 more years (he’ll be 55yrs old) has 20 yrs TAFMS and 23 yrs of points. Question is what’s his retirement at TAFMS or PCARS?

Mahalo

Dean O

Ryan Guina says

Dean, I can’t speak for Doug, but I’ll answer to the best of my ability.Your TAFMS is your Total Active Federal Military Service. This only counts your active duty time. Your PCARS should inclue all of your points, including TAFMS and inactive points. You need 20 years worth of TAFMS to qualify for active duty retirement benefits. You just need 20 good years to qualify for Guard or Reserve retirement benefits.

In your example, this person can retire with active duty benefits once he has 20 years of TAFMS. But since he will have 23 years worth of points, his retirement would be based on 23 years worth of points. And since it would be the equivalent of an active duty retirement, it would start the month after he retires, instead of him having to wait until age 60.

I hope this helps!

Dean O says

Mahalo Ryan.

It clears up a lot of confusion we have between the Air National Guard (AGR’s, Technicians, and Week End Warriors) and Active Duty Air Force and their retirements.